The crypto market feels like a ghost town right now. No wild pumps, no viral narratives taking over X like before. Crypto folks are moving from chasing pumps and small caps to gambling.

It’s just a quiet grind with prices stuck in ranges and sentiment in the dumps. Ethereum’s barely moving within the $1,900-$2,100 price range. Even Vitalik reminded us that without proper utility, it might turn into dust.

Retail is back in the 2018’s trenches, farming low-reward drops or chasing memecoins that rug in hours. This later had Solana’s tanked hard from $295 highs to $78-$81 as if nothing happened.

The causes of these dumps are practically known, and there’s nobody to blame. It’s a mix of lingering scars from last year’s chaos of October 10/10. Overfunded projects that nobody uses, with VC extracting liquidity from weak hands. High-profile rugs and Solana’s endless backlash, coupled with shocking revelations like Epstein’s Bitcoin ties. Let’s explore these causes in more depth:

1. The October 10/10 Chaos That Still Haunts Everything

The 10/10 is the most discussed event right now on CT, with Binance receiving all the blame. As it goes in OKX CEO Star’s view, Ethena’s synthetic USDe has been oversubscribed on Binance with an aggressive promotion campaign of 12% APY.

It resulted in oversubscription, and USDe supply skyrocketed as users used leverage to chase yields, such as swapping USDT to USDe and using it as collateral to borrow more USDT and repeating for 24-70% effective APYs.

It’s an unbelievable move, but it resulted in $19-20 billion in liquidation in leverage. That’s the largest single-day wipeout ever. The total market capitalization fell by $400 billion. This provoked a skepticism that made everyone run away from the falloff, creating a big wipeout!

2. Big VC-Backed Projects Nobody’s Using

Another big drama trending on CT right now is the backlash over the Layer Zero chain launch. It’s perceived that VCs are launching rug puller chains that nobody finds interesting. These are examples of projects with big funding but floating at floor and nobody uses them, including the team itself:

- Humanity Protocol ($1 billion in VC valuation) at $285 million cap (-71.5 percent),

- Fuel Network ($1 billion to $11 million, -98.9 percent)

- Privasea ($180 million to $1 million, down 99.4%).

- High-profile flops such as ICP, DYM, FLOW, Yield Protocol, and Eclipse have all declined by more than 90% due to poor execution and a lack of demand.

3. Ethereum’ Stagnant Price Enigma

Ethereum remains a mystery to many investors, and the price has consistently retraced its steps back to the 2018 entry point. Big investors, including Bitmine, are down $7.5-7.8 billion in unrealized losses on ETH ETFs. And, most conventionally, Ethereum layer 2s are becoming pointless due to slow transactions, raising the question of whether they will become layer 1.

At this point in the market, finding a new narrative is highly critical right now. The stablecoin market is taking over, making every protocol launch its stablecoin. All these inclusively are making the purpose of holding alt tokens so biased.

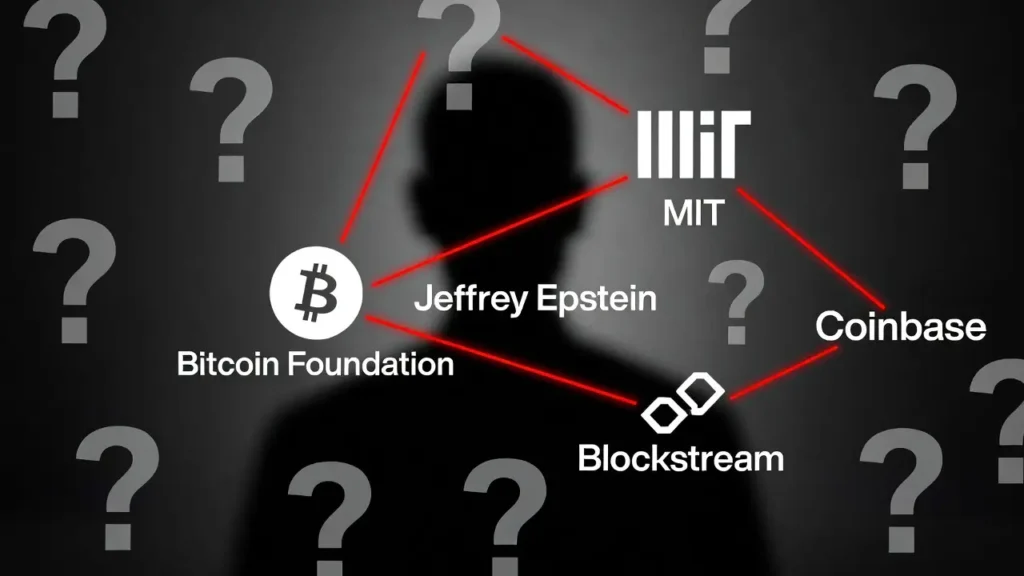

4. Jeffrey Epstein’s Bitcoin Connection

Epstein’s cryptocurrency ties are also contributing to market distrust. According to DOJ file releases, he invested $3 million in Coinbase’s 2014 round (netted millions), $500 thousand in Blockstream, and underwrote MIT’s DCI (74% core code commits after Epstein).

However, key figures have denied ties with Epstein’s empire, such as Adam Back, and Ripple dismissed sabotage. This taints origins, adds volatility, and keeps the market silent as trust erodes.

5. Project Rugs After Launch

Trove raised $11.5 million in the Hyperliquid ICO, and the developers switched to Solana without refunds. The crash resulted in a $2.5M loss of liquidity. Team wallets moved bonds and funds to casinos/memecoins ($546 SOL to $DONT). CT reacted with a scam report.

By the same token, Aztec, claiming to be a legitimate ETH ZK-privacy protocol with years of team effort, is eroding trust at launch after raising over $200 million.

6. Solana’s rug epidemic tanking the price.

You’re probably familiar with Pump.fun, the platform where thousands of memecoins were launched every second.

It was widely criticized for destroying the meme economy and the good vibes. Meanwhile, X’s top article winner of $1 million is accused of stealing $600,000 in rugs.

Furthermore, trending memes never reach a $10 million market capitalization, and those that do are depleted within a few hours. Nothing sounds sustainable; both the price and the ecosystem’s credibility are tanking.

Conclusion

That being said, real builders are building, and the Solana ecosystem is capturing AI agents and powering new DeFi protocols. This silence will not last indefinitely; macro relief or new narratives may change that. For the moment, these scars keep things under control.

More breakdowns in our Crypto News.

Want More Free Airdrops?

Hunting drops? FreeCoins24.io has Solana, L2, perp DEX lists. Airdrop Calendar Here

Stay Updated

Real-time buzz, alerts, scoops:

- Twitter: @FreeCoins24

- Telegram: t.me/FreeCoins24 Join us.

FAQ:

Q1: What was the October 10/10 event?

$19 billion in liquidations, a $400 billion market capitalization loss, the largest crash day in history, and lingering sentiment.

Q2: Why are VC-backed projects failing?

Overfunded ($25 billion or more by 2025), with no users; for example, Humanity Protocol is down 71.5%, Fuel is down 98.9%. Hype bursts damage trust.

Q3: What’s the Ethereum enigma?

Price stuck at $1,900-$2,100, down 7% in January; L2 fragmentation and Solana rivalry drive retail to the brink.

Q4: How’s Epstein connected to Bitcoin?

Funded MIT developers, Blockstream ($500K), and Coinbase ($3M) fuel FUD and taint origins with 2026 files.

Q5: What happened with Trove rug?

Raised $11.5 million, switched to Solana, dumped 95-98%, drained $2.5 million, and optimized scam with casino funnels.

Q6: Aztec rug case?

Legit protocol, no rug, but similar hype-to-pull patterns highlight the $6 billion losses in 2025.

Q7: Why Solana’s backlash?

$600K X winner rugs, $534K fake illness drain, SOL tanked 60-72%.

Q8: Is the market silence temporary?

Macro relief or new narratives (AI/RWAs) are likely to turn it around, but FUD/scars keep it quiet for the moment.

Q9: How’s this affecting retail?

Pushed into trenches, farming low-reward drops, chasing memecoins under the rug, waiting for recovery.