In the shadowed corridors of crypto space, where transparency is both a virtue and a vulnerability, a seismic shift is underway. Zero-Knowledge Proofs (ZKPs), those cryptographic sleight-of-hand tricks that verify truths without revealing secrets, are no longer the domain of niche cypherpunks. They’re fueling a billion-dollar “black market” boom. This has nothing to do with illicit trades, but a legitimate explosion in privacy tech that’s reshaping DeFi, institutional finance, and even AI. As of November 15, the ZKP ecosystem’s total value locked (TVL) has surged past $3.9 billion across leading protocols, while the broader privacy sector’s market cap has exploded to $36.5 billion, up 15.3% in just 24 hours.

This isn’t speculation; it’s structural, driven by halving, upgrades, and a rotation into verifiable anonymity amid tightening regs. Here’s the dispatch from the front lines.

For users looking for a reliable, fast and low-fee exchange to trade ZKPs privacy plays, we recommend Bitunix. You can join now and get exclusive welcome Bonus up to 20% extra on your first deposit. The more you deposit and trade, the bigger your rewards! Bonus.

1. The Mechanics: ZKPs as the Engine of Enigmatic Efficiency

At the heart of this boom lies a simple yet profound innovation. ZKPs allow users to prove statements, like “this transaction is valid” or “I’m compliant with KYC“, without exposing the underlying data. In crypto terms, that’s zk-SNARKs and zk-STARKs powering Layer 2 rollups, where thousands of off-chain computations are bundled and verified on-chain in a single, privacy-preserving proof.

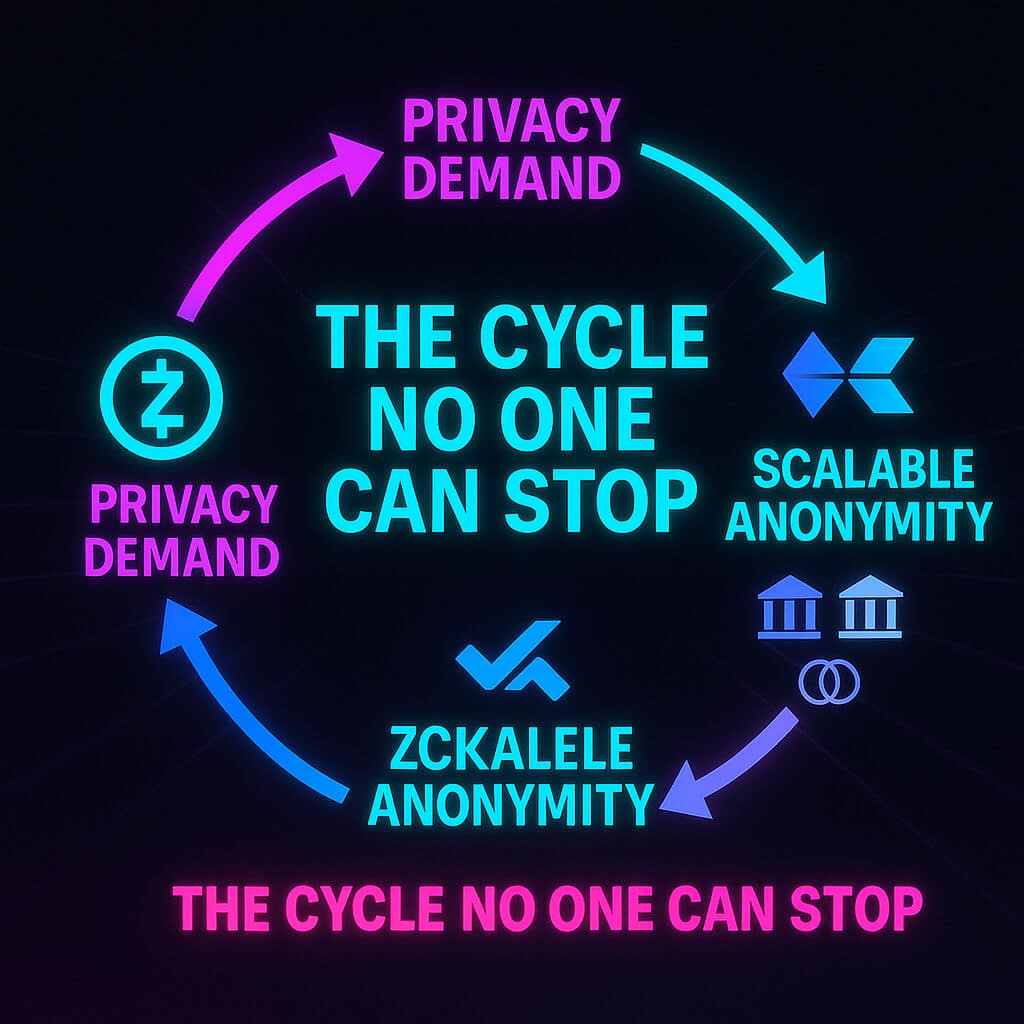

Consider the most recent Era+ upgrade from zkSync, which increased throughput to 4,000 TPS while fees dropped to less than $0.05, a 90% reduction from the Ethereum mainnet. Following this, StarkNet’s Quantum improvements made it possible to achieve enterprise-grade privacy in real-world assets (RWAs) at 15,000 TPS. What came of it? the flywheel effect. Because of the scalable anonymity offered by these platforms, developers are drawn to them, dApps are growing (up 89% in six months on Polygon zkEVM), and capital is flowing in. ZKP protocols have a combined market cap of $678.7 million, which is a 156% increase from the previous year, and daily transaction volumes on zkSync alone have reached about $278.7K.

However, it’s the tongue-in-cheek “black market” angle that highlights the appeal. In a world of on-chain surveillance (Chainalysis tracking billions in flows annually), ZKPs create compliant shadows. Banks like JP Morgan (partnered with StarkWare in September) and HSBC (via Polygon zkEVM in October) are testing these for private settlements, dodging MiCA’s transparency mandates without full disclosure.

The global ZKP market, valued at $75 million in 2024 revenue, is projected to exceed $10 billion by 2030, fueled by privacy demands in decentralized identity and blockchain.

2. Momentum Metrics: A Sector Heating Up Under the Radar

BTC hovering at $95K, total crypto market cap at $3.4 trillion, has spotlighted privacy as a safe harbor. Here are the standout movers lighting up the privacy leaderboard right now:

- Zcash (ZEC) – $605.93 Up over 1,000% in two months on halving anticipation (November 18) and zk upgrades. Shielded balances now ~30% of supply – an all-time high.

- Monero (XMR) – $397.84 +20% this month, powered by RandomX upgrade hype and a classic short squeeze.

- Litecoin (LTC) – $97.52 +18% on Mimblewimble v2 rollout and fresh cross-chain bridge integrations.

- zkSync (ZK) – $0.05131 +150% month-to-date after Era+ TPS boost and major DeFi inflows.

- StarkNet (STRK) – $0.1827 +40% on Quantum enterprise pilots and capturing 41% of L2 TVL.

- zkPass (ZKP) – ~$0.0033 24-hour volume exploding 650%+ on cross-chain verification buzz – still early, but eyes are on the December TGE.

These aren’t isolated pumps; the entire privacy sector is up 84% in the last 30 days, with ZEC alone responsible for roughly 700% of that momentum. Active daily users across key privacy chains sit at 1,072, RSI around 65, plenty of room left to run. Proof generation costs down 72% YoY, energy consumption slashed 88%. The flywheel is spinning.

3. The Bigger Picture: Regulatory Shadows and Institutional Spotlights

This boom isn’t happening in a vacuum. The EU’s MiCA framework demands “risk-based” privacy, creating a moat for ZKP-compliant chains. U.S. Treasury pilots explore ZKPs for identity verification, while geopolitical jitters amplify demand for “provable anonymity.” Institutions are circling: Deutsche Bank’s zkSync tie-up in November, zkPass’s 10 million+ proofs across Binance and Coinbase. Is this the “black market”? Secure inference is sorely needed in the $1.5 trillion AI data economy. ZKPs demonstrate model outputs without disclosing inputs, opening up billions in enterprise licensing deals worth between $50,000 and $500K annually.

X users quantify the heat: ZEC, DASH, and STRK lead the “Privacy Coins Surge: Market Cap Explodes 80% in 7 Days” threads. However, despite 400,000+ testnet users for zkVerify signal developer conviction, centralization in proof hardware continues to be a chokepoint, and UX challenges slow retail. Zcash’s shielded balances have increased 125% year-to-date to 27% of supply (~$1B+), demonstrating the widespread use of apps like Zashi for self-custody swaps.

4. Outlook: Billions in the Shadows, With Eyes on 2026

The ZKP market is expected to reach $4.8–$7.2 billion by year’s end (base to bull), with a 21.4% compound annual growth rate (CAGR) by 2033, reaching $8.52 billion with a target of 50,000 TPS and sub-second finality. Bull case? TVL reaches $10 billion, while ZEC/XMR reaches $1,000/$550 due to institutional floods (Grayscale Zcash Trust AUM up 228% to $150M+). The base? A steady rotation. Bear? Efficiency gains limit the downside, but regulatory delays cap at $2.1 billion. More fireworks are hinted at by zkPass’s December TGE, which was oversubscribed 3,700% in presale.

ZKPs for scale and OG privacy for sovereignty (ZEC’s zk-SNARKs as “HTTPS for money”) are the hybrid strategies that work best for investors. See the tokenomics of Zama and Aztec’s Q4 drop. The boom in the “black market”? Secure, scalable, and sovereign, it is the evolution of crypto from transparent ledger to veiled vault.

Conclusion

ZKPs privacy crypto boom is 2025’s stealth megatrend, $3.9B TVL, zk-shields powering black market surges and legit revolutions alike. From Zcash’s halving rocket to zkPass’s AI edge, privacy’s no longer optional; it’s the billion-dollar black hole sucking in capital. Shadows grow, but so does the light, trade the boom, mind the dark.

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.

Stay Updated

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Dive into ZKPs trades? Register on BitUnix with code Freecoins24, Claim your exclusive bonus.