1. Introduction: Financial Inclusion in the Modern World

Financial inclusion remains a significant challenge worldwide, with billions of people lacking access to essential financial services. According to the World Bank, nearly 1.7 billion adults remain unbanked, unable to access basic banking services such as savings accounts, credit, or insurance. This financial exclusion limits their ability to improve their economic circumstances and perpetuates poverty. Cryptocurrencies, powered by blockchain technology, are emerging as a transformative solution to this problem, offering an accessible and cost-effective alternative to traditional financial systems. This article explores the role of cryptocurrencies in advancing financial inclusion, the challenges they face, and their potential to create a more equitable global financial landscape.

Why Cryptocurrencies Matter in Financial Inclusion:

Cryptocurrencies provide an alternative financial system that operates beyond traditional banking, making it accessible to those excluded from the global financial ecosystem.

2. How Cryptocurrencies Advance Financial Inclusion

2.1 Access to Financial Services for the Unbanked

One of the most significant contributions of cryptocurrencies to financial inclusion is providing access to financial services for the unbanked. Traditional banking systems often require documentation, credit history, and a minimum deposit, which many individuals in developing countries cannot provide. Cryptocurrencies eliminate these barriers by allowing anyone with a smartphone and internet access to create a digital wallet and participate in the global economy.

- Key Advantages:

- No Minimum Requirements: Unlike traditional banks, crypto wallets do not require a minimum balance, making them accessible to low-income individuals.

- Global Accessibility: Cryptocurrencies enable cross-border transactions, allowing users to send and receive money without relying on banks or money transfer services.

- Increased Financial Freedom: Individuals can save, transfer, and invest money using cryptocurrencies without needing a traditional bank account.

2.2 Lower Transaction Costs

High transaction fees in traditional financial systems can be a significant burden for those with limited financial resources. For instance, international remittances, which are crucial for many families in developing countries, often involve hefty fees that reduce the amount received by the beneficiary. Cryptocurrencies, by eliminating intermediaries, reduce these transaction costs, allowing more money to reach those in need.

- Cost Efficiency:

- Reduced Fees: Cryptocurrency transactions typically involve lower fees compared to traditional banking or remittance services.

- Direct Transfers: Cryptocurrencies facilitate peer-to-peer transactions, eliminating the need for costly intermediaries.

2.3 Empowering Micro-Entrepreneurs and Small Businesses

Cryptocurrencies also empower micro-entrepreneurs and small businesses by providing access to capital and new markets. Traditional financing options, such as loans from banks, are often inaccessible to small businesses in developing regions due to lack of credit history or collateral. Cryptocurrencies offer an alternative by enabling crowdfunding, peer-to-peer lending, and decentralized finance (DeFi) platforms that provide microloans and investment opportunities.

- Entrepreneurial Benefits:

- Access to Capital: Entrepreneurs can access funding through crypto-based lending platforms without needing extensive documentation or collateral.

- Global Market Reach: Cryptocurrencies enable small businesses to engage in international trade, reaching customers and investors worldwide.

- Decentralized Finance (DeFi): DeFi platforms offer microloans and investment opportunities, bypassing traditional financial institutions.

3. Challenges Facing Cryptocurrencies in Promoting Financial Inclusion

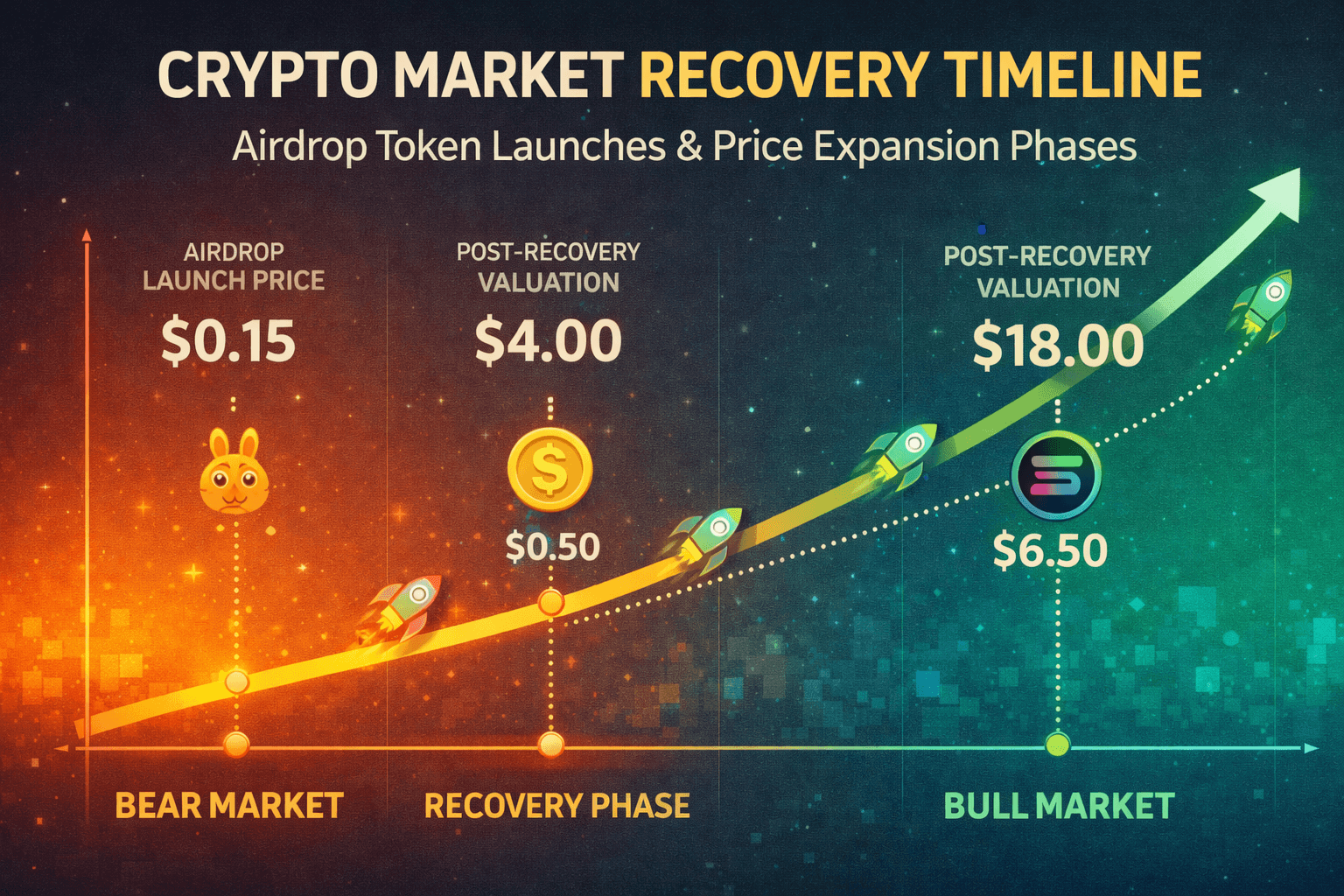

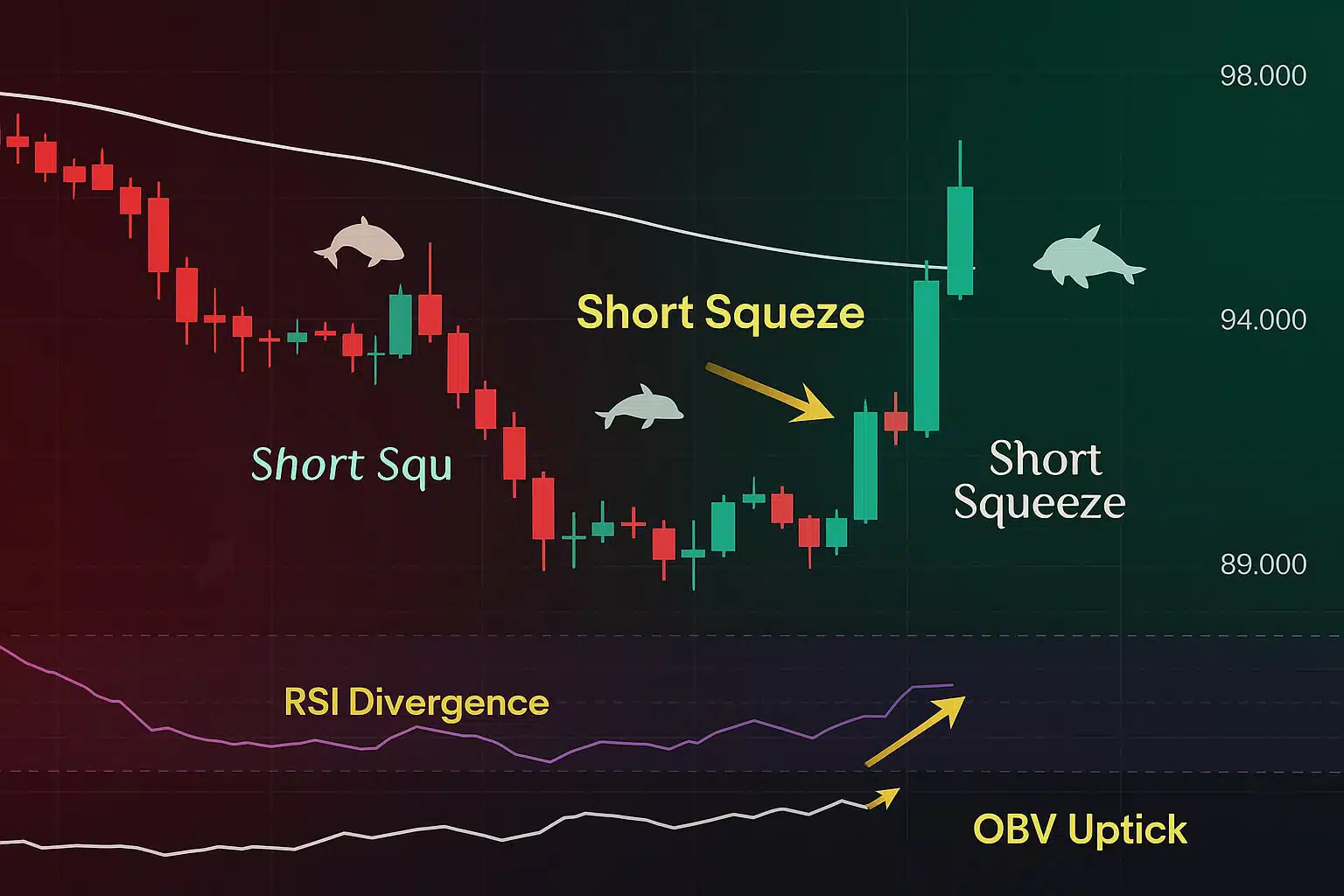

3.1 Volatility and Risk

Despite their potential, cryptocurrencies face significant challenges in promoting financial inclusion, primarily due to their volatility. The value of cryptocurrencies can fluctuate wildly, posing a risk for individuals who rely on them for daily transactions or savings. This volatility can deter the unbanked and underbanked from adopting cryptocurrencies as a stable financial solution.

- Risks of Volatility:

- Unpredictable Value: Rapid fluctuations in cryptocurrency value can lead to losses, making them risky for everyday financial use.

- Hesitation to Adopt: The potential for loss may discourage individuals from adopting cryptocurrencies as a reliable financial tool.

3.2 Limited Digital and Financial Literacy

Another challenge is the limited digital and financial literacy among populations that could benefit most from cryptocurrencies. Understanding how to use digital wallets, manage private keys, and navigate the cryptocurrency market requires a level of knowledge that many unbanked individuals may not possess. Without proper education and support, the risk of loss due to errors or fraud increases.

- Educational Barriers:

- Low Literacy Levels: Many potential users lack the digital or financial literacy needed to safely use cryptocurrencies.

- Security Risks: Without proper education, users are more susceptible to scams, fraud, and mistakes that could lead to financial loss.

3.3 Regulatory Uncertainty

Regulatory uncertainty surrounding cryptocurrencies presents another barrier to their widespread adoption for financial inclusion. Many governments have yet to establish clear regulations regarding the use of cryptocurrencies, leading to legal and operational risks for users. In some countries, cryptocurrencies face outright bans, which limits their potential to promote financial inclusion.

- Regulatory Challenges:

- Varying Regulations: Different countries have different approaches to regulating cryptocurrencies, leading to confusion and uncertainty.

- Potential Bans: In some regions, cryptocurrencies are banned or heavily restricted, limiting their availability and use.

4. The Future Potential of Cryptocurrencies in Financial Inclusion

4.1 Stablecoins and Reduced Volatility

To address the issue of volatility, the development and adoption of stablecoins—cryptocurrencies pegged to stable assets like the US dollar—are gaining traction. Stablecoins offer the benefits of cryptocurrencies, such as low transaction costs and accessibility, while minimizing the risk of value fluctuations. By using stablecoins, unbanked populations can enjoy a more stable and reliable financial solution.

- Stablecoin Benefits:

- Price Stability: Pegging to stable assets reduces volatility, making stablecoins more suitable for everyday transactions.

- Increased Adoption: The stability of these coins may encourage more people to adopt cryptocurrencies for financial transactions.

4.2 Expanding Digital Literacy Programs

To maximize the benefits of cryptocurrencies for financial inclusion, expanding digital literacy programs is essential. Governments, NGOs, and private sector players can collaborate to provide education and training on how to use cryptocurrencies safely and effectively. These programs could focus on teaching the basics of digital wallets, security best practices, and the potential risks and rewards of cryptocurrency use.

- Education Initiatives:

- Community Training: Localized training programs can help bridge the knowledge gap, enabling more people to use cryptocurrencies confidently.

- Online Resources: Accessible online tutorials and resources can provide ongoing support and education for new users.

4.3 Collaboration with Traditional Financial Institutions

As the cryptocurrency ecosystem evolves, there is potential for collaboration between traditional financial institutions and cryptocurrency platforms to promote financial inclusion. Banks and fintech companies could integrate cryptocurrencies into their services, providing a bridge between the traditional financial system and the emerging digital economy. This collaboration could enhance accessibility, reduce costs, and provide a more comprehensive range of financial services to underserved populations.

- Partnership Opportunities:

- Hybrid Services: Banks could offer crypto-based services alongside traditional banking, providing more options for users.

- Inclusive Finance: Collaboration could lead to the development of products and services specifically designed to meet the needs of the unbanked and underbanked.

Conclusion: Cryptocurrencies as a Tool for Global Financial Inclusion

Cryptocurrencies have the potential to significantly advance financial inclusion by providing accessible, affordable, and secure financial services to the unbanked and underbanked populations worldwide. While challenges such as volatility, limited literacy, and regulatory uncertainty remain, the ongoing development of stablecoins, education initiatives, and collaboration with traditional financial institutions could help overcome these barriers. As the adoption of digital currencies grows, they may play a crucial role in bridging the global financial gap and fostering economic empowerment for all.

For more insights and detailed analysis on how cryptocurrencies are transforming finance, explore our Cryptocurrency and Financial Inclusion section.

Stay Updated

For the latest updates on how cryptocurrencies are driving financial inclusion, follow us on:

Stay informed with the latest strategies and insights in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Looking to explore the world of cryptocurrencies? Sign up on Bybit today and take advantage of up to $30,000 in deposit bonuses. Start your journey towards financial inclusion with secure and innovative crypto trading options.