Understanding DeFi: A Beginner’s Guide to Decentralized Finance

Decentralized Finance, or DeFi, is revolutionizing the financial industry. This guide will take you through the basics of DeFi, its benefits, risks, and how you can get started. By the end, you’ll have a solid understanding of what DeFi is all about and why it’s gaining so much traction.

Are you ready to dive into the world of DeFi? Let’s get started!

What is DeFi?

DeFi, short for decentralized finance, refers to a new financial ecosystem that operates without traditional banks and financial institutions. It uses blockchain technology to offer financial services like lending, borrowing, trading, and earning interest, all without intermediaries.

How Does DeFi Work?

DeFi leverages smart contracts, which are self-executing co

ntracts with the terms directly written into code. These contracts run on decentralized blockchain networks, such as Ethereum. When certain conditions are met, the contracts execute automatically, ensuring transparency and reducing the need for intermediaries.

Key Components of DeFi

- Decentralized Exchanges (DEXs): Platforms like Uniswap and Sushiswap allow users to trade cryptocurrencies directly without a central authority.

- Lending Platforms: Services like Aave and Compound let users lend their crypto assets to others and earn interest in return.

- Stablecoins: Cryptocurrencies like DAI and USDC are pegged to stable assets like the US dollar, offering stability in the volatile crypto market.

- Yield Farming: A way to earn rewards by staking or lending crypto assets within DeFi protocols.

Benefits of DeFi

- Accessibility: Anyone with an internet connection can access DeFi services, regardless of location.

- Transparency: Transactions and smart contracts are recorded on a public blockchain, ensuring full transparency.

- Control: Users maintain control over their assets, unlike traditional banking systems where banks hold your funds.

- Innovation: DeFi is a hotbed for financial innovation, with new protocols and services emerging regularly.

Risks of DeFi

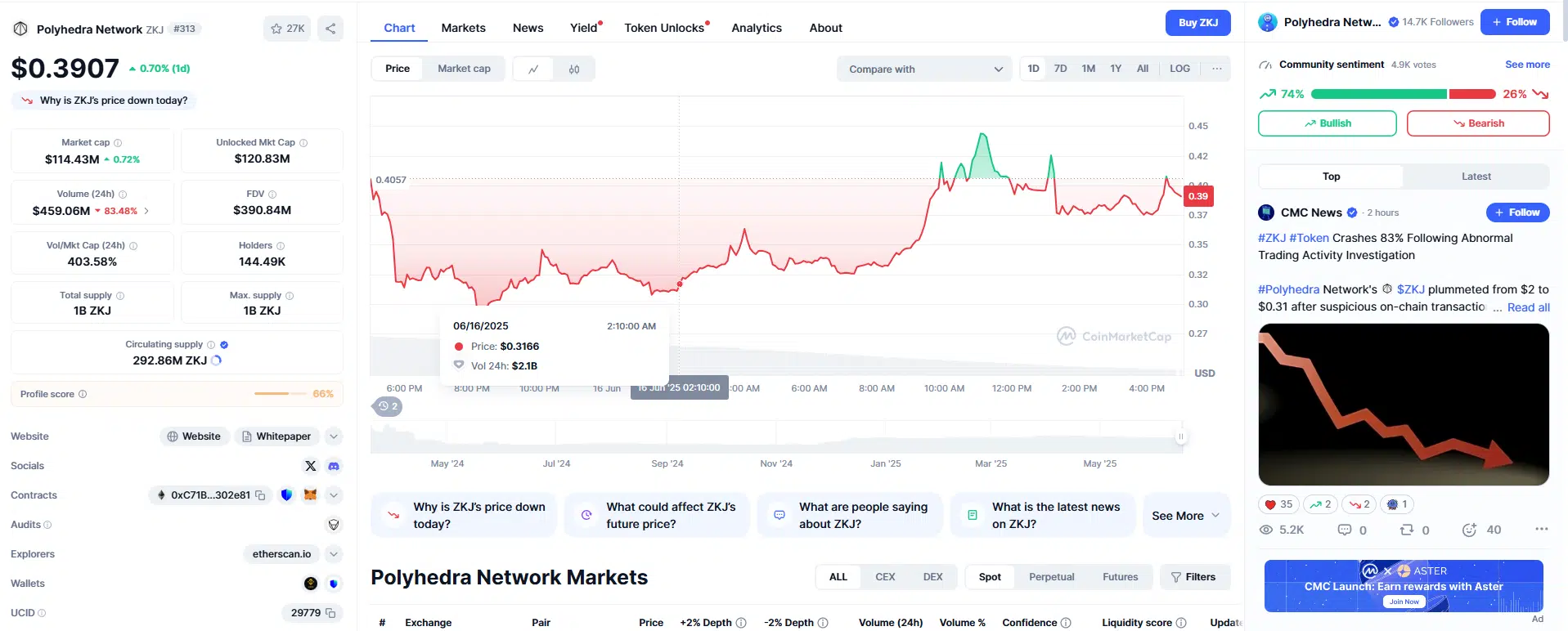

- Volatility: Cryptocurrencies are known for their price volatility, which can affect DeFi investments.

- Smart Contract Bugs: Errors in smart contract code can lead to significant losses.

- Regulatory Uncertainty: DeFi operates in a regulatory gray area, and future regulations could impact its growth and usability.

Getting Started with DeFi

- Set Up a Wallet: Create a crypto wallet, such as MetaMask, to interact with DeFi platforms.

- Buy Cryptocurrency: Purchase Ethereum (ETH) or other required tokens on an exchange like Coinbase or Binance.

- Explore DeFi Platforms: Start using DeFi platforms by connecting your wallet. Try out lending, borrowing, or trading to get a feel for the ecosystem.

- Stay Informed: Follow DeFi news and updates to keep abreast of new opportunities and risks.

Wrapping Up: The Future of Finance

DeFi is transforming the way we think about finance. It offers unprecedented access, control, and transparency, making financial services available to everyone. However, it also comes with risks that should not be overlooked. As you explore the DeFi space, stay informed and cautious to make the most of this revolutionary technology.

FAQs about DeFi

- What is DeFi? DeFi, or decentralized finance, is a financial ecosystem that uses blockchain technology to offer financial services without traditional intermediaries.

- How do I get started with DeFi? To get started with DeFi, set up a crypto wallet like MetaMask, buy cryptocurrency, and explore DeFi platforms by connecting your wallet and trying out various services.

- What are the benefits of DeFi? DeFi offers benefits like accessibility, transparency, user control, and a continuous stream of financial innovation.

- What risks are associated with DeFi? DeFi comes with risks such as cryptocurrency volatility, smart contract bugs, and regulatory uncertainty.

- Can anyone access DeFi services? Yes, anyone with an internet connection can access DeFi services, making them globally inclusive.

Interesting External Links:

By understanding and engaging with DeFi, you can be part of the future of finance that’s decentralized and inclusive. Happy exploring!