1. The Rise of Crypto Lending and Borrowing

As the cryptocurrency market continues to grow, so does the variety of financial services available within it. Among these services, crypto lending and borrowing have emerged as powerful tools for both investors and everyday users. By allowing individuals to lend their crypto assets to earn interest or borrow assets against their holdings, these services have opened up new possibilities for managing and growing wealth in the digital economy. But how exactly does crypto lending and borrowing work, and what do you need to know to get started?

Why It Matters

Crypto lending and borrowing provide opportunities for users to earn passive income, access liquidity, and diversify their investment strategies. However, like any financial service, these activities come with their own set of risks and complexities. Understanding the basics is essential for anyone looking to participate in the growing world of crypto finance.

2. What is Crypto Lending?

Crypto lending is a process where cryptocurrency holders lend their assets to borrowers in exchange for interest. Unlike traditional bank loans, crypto lending is typically conducted through decentralized platforms or centralized services that use blockchain technology to facilitate and secure transactions.

2.1 How Crypto Lending Works

In a typical crypto lending scenario, lenders deposit their cryptocurrency into a lending platform. The platform then makes these assets available to borrowers, who agree to repay the loan with interest. The interest rates, loan terms, and collateral requirements are usually defined by the platform or through smart contracts.

- Example: Suppose you own 1 Bitcoin (BTC) and wish to earn interest on it. You could deposit your BTC into a crypto lending platform like BlockFi or Aave. The platform would then lend your BTC to a borrower who needs it, and you would earn interest on your deposit over time.

- Why It Matters: Crypto lending offers lenders the potential to earn passive income from their assets, which might otherwise remain idle in their wallets. It also provides liquidity to borrowers who need funds without selling their crypto holdings.

2.2 Types of Crypto Lending

There are generally two types of crypto lending: centralized and decentralized.

- Centralized Lending: In centralized lending, platforms like BlockFi or Nexo act as intermediaries, managing the lending process, holding collateral, and setting interest rates. These platforms typically require users to trust them with their assets, as they hold the private keys.

- Decentralized Lending (DeFi): In decentralized lending, platforms like , and use smart contracts to automate the lending process. These platforms do not require intermediaries, and users maintain control of their private keys. Interest rates are often determined by supply and demand dynamics on the platform.

Why It Matters: Both centralized and decentralized lending offer unique advantages and risks. Centralized platforms may offer more user-friendly experiences, while DeFi platforms provide greater control and transparency.

3. What is Crypto Borrowing?

Crypto borrowing allows individuals to borrow funds by using their cryptocurrency as collateral. Borrowers pledge their crypto assets to obtain a loan, which they must repay with interest. This service can be particularly useful for those who need liquidity but do not want to sell their crypto holdings.

3.1 How Crypto Borrowing Works

To borrow crypto, a user must first deposit collateral—usually in the form of a different cryptocurrency—into a lending platform. The platform then provides the borrower with a loan, often in stablecoins or other cryptocurrencies. The borrower must repay the loan with interest to retrieve their collateral.

- Example: If you own 10 Ethereum (ETH) but need access to US dollars, you could deposit your ETH as collateral on a platform like MakerDAO and borrow DAI, a stablecoin pegged to the US dollar. Once you repay the loan plus interest, you can withdraw your ETH.

- Why It Matters: Crypto borrowing provides a way to access funds without having to liquidate your assets. This can be particularly beneficial in a bull market, where selling your crypto might mean missing out on potential gains.

3.2 Types of Crypto Borrowing

Like lending, crypto borrowing can also be categorized into centralized and decentralized models.

- Centralized Borrowing: Centralized platforms require borrowers to deposit collateral with the platform itself. The platform manages the loan, interest rates, and collateral requirements. Borrowers rely on the platform to handle these processes securely and fairly.

- Decentralized Borrowing (DeFi): In decentralized borrowing, smart contracts manage the loan process. Borrowers deposit collateral into a smart contract, which then automatically disburses the loan. The contract also enforces repayment terms and liquidation conditions if the collateral’s value falls below a certain threshold.

Why It Matters: Centralized borrowing may offer easier access to loans and customer support, while decentralized borrowing provides transparency and eliminates the need for intermediaries.

4. The Benefits of Crypto Lending and Borrowing

Crypto lending and borrowing offer several benefits that make them attractive to users within the cryptocurrency space.

4.1 Earning Passive Income

For lenders, the primary benefit of crypto lending is the ability to earn interest on their assets. Instead of leaving your cryptocurrency idle in a wallet, you can lend it out and generate passive income.

- Example: If you hold stablecoins like USDC or DAI, lending them on a platform like Aave can earn you interest rates that are often higher than those offered by traditional savings accounts.

Why It Matters: Earning passive income allows crypto holders to grow their wealth without actively trading or selling their assets.

4.2 Accessing Liquidity Without Selling Assets

Crypto borrowing allows users to access funds without selling their assets. This is particularly useful in a rising market, where selling could mean missing out on potential gains.

- Example: A long-term Bitcoin holder might borrow stablecoins against their BTC to cover short-term expenses, avoiding the need to sell and incur potential capital gains taxes.

Why It Matters: Accessing liquidity while retaining exposure to your crypto holdings enables you to meet financial needs without sacrificing future growth potential.

4.3 Flexibility and Control

Decentralized platforms provide users with greater flexibility and control over their assets. Lenders and borrowers can interact with smart contracts directly, often without needing approval or facing restrictions imposed by centralized platforms.

- Example: On platforms like Compound, users can choose their lending and borrowing terms based on real-time market conditions, giving them more control over their financial decisions.

Why It Matters: Flexibility and control are key benefits for users who prefer to manage their own financial transactions without relying on intermediaries.

5. Risks and Considerations in Crypto Lending and Borrowing

While crypto lending and borrowing offer significant benefits, they also come with risks that users should carefully consider.

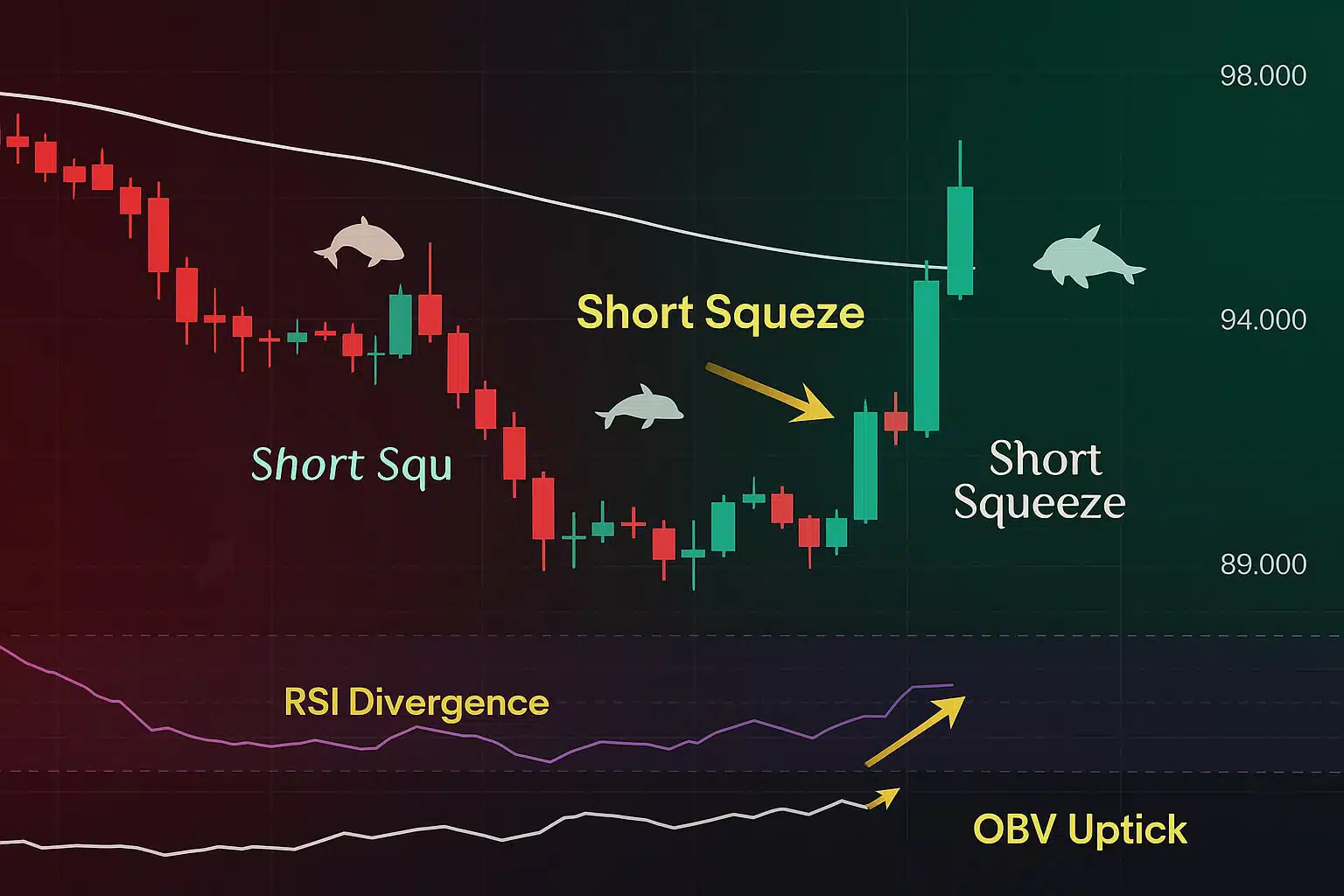

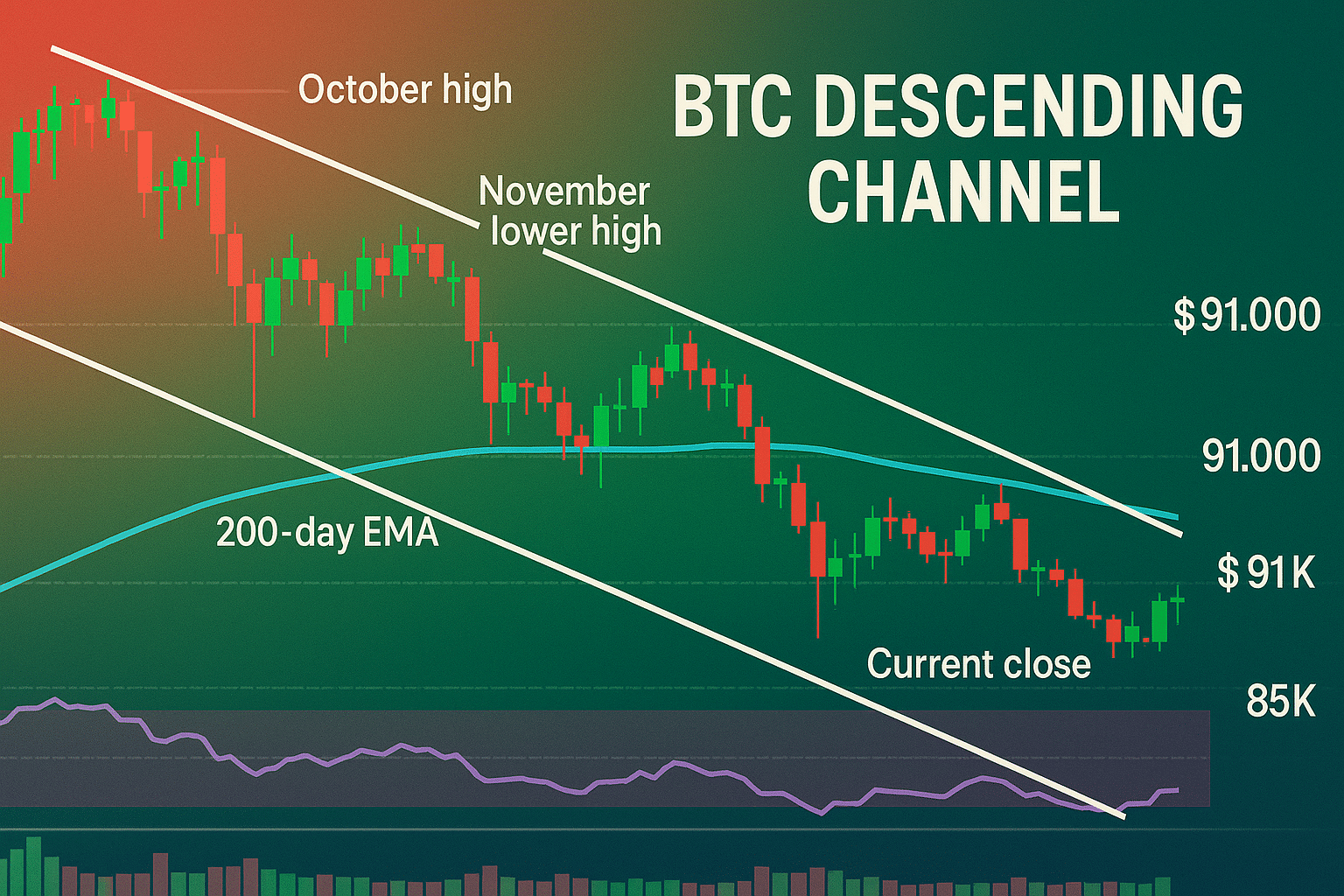

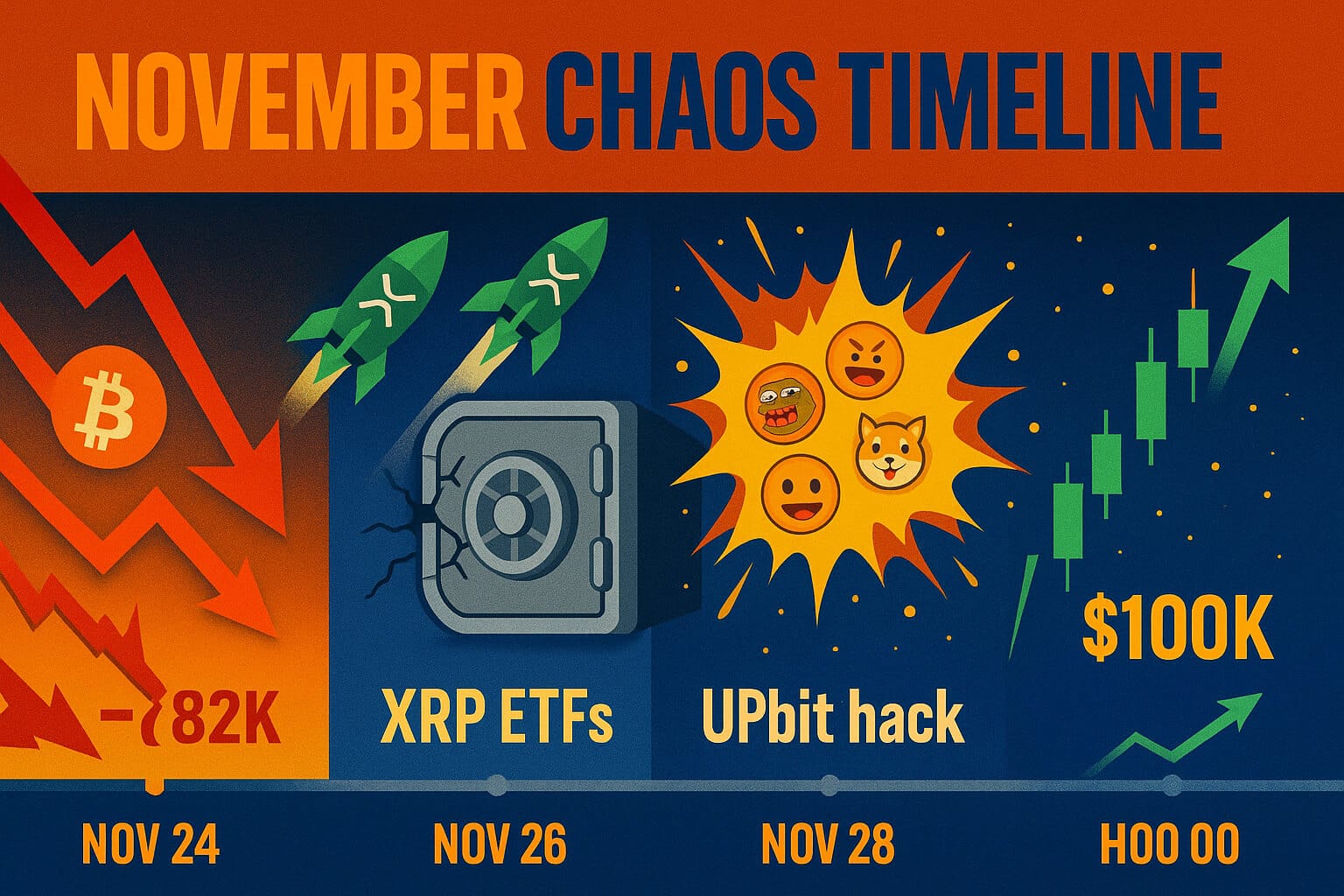

5.1 Market Volatility

Cryptocurrency prices are notoriously volatile, which can affect both lenders and borrowers. If the value of the collateral falls significantly, borrowers may face liquidation, and lenders may not recover the full value of their assets.

- Example: A borrower who pledges ETH as collateral might face liquidation if the price of ETH drops suddenly, reducing the value of their collateral below the required threshold.

Why It Matters: Market volatility can lead to unexpected losses, making it crucial for users to monitor their collateral and understand the risks involved.

5.2 Platform Security

The security of lending and borrowing platforms is another critical consideration. Hacks, smart contract bugs, or platform insolvency can result in the loss of funds for both lenders and borrowers.

- Example: In 2020, the DeFi platform bZx was exploited in a series of attacks that resulted in the loss of millions of dollars. This incident highlighted the importance of using secure and well-audited platforms.

Why It Matters: Platform security is paramount to safeguarding your assets. Users should choose reputable platforms with strong security measures and consider diversifying their activities across multiple platforms to reduce risk.

5.3 Regulatory Risks

The regulatory environment for crypto lending and borrowing is still evolving. Changes in regulation could impact the availability and legality of these services in certain regions.

- Example: Regulatory crackdowns on crypto lending platforms in countries like the United States have led to increased scrutiny and, in some cases, the shutdown of services.

Why It Matters: Regulatory risks can affect your ability to access and use crypto lending and borrowing services. Staying informed about regulatory developments is essential for mitigating potential disruptions.

Conclusion: Navigating the World of Crypto Lending and Borrowing

Crypto lending and borrowing have opened up new financial opportunities for cryptocurrency users, offering ways to earn passive income, access liquidity, and manage assets more effectively. However, these services also come with risks, including market volatility, platform security, and regulatory challenges. By understanding the basics and carefully evaluating the platforms and terms involved, users can make informed decisions and take full advantage of what crypto lending and borrowing have to offer.

For more insights and detailed guides on cryptocurrency finance, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest updates on crypto lending and borrowing, follow us on:

Stay informed with the latest strategies and developments in the world of cryptocurrency at FreeCoins24.io.

Special Offer

Ready to explore crypto lending and borrowing? Sign up on Bybit today and take advantage of up to $30,000 in deposit bonuses. Discover how you can earn and borrow in the crypto space.