In a move that has sent shockwaves through the cryptocurrency world, Donald Trump, the newly re-elected 47th President of the United States, along with his crypto-savvy team, has reportedly purchased over $47 million worth of Wrapped Bitcoin (WBTC) in a matter of hours. This bold investment underscores the growing role of crypto assets in financial strategy and positions the U.S. presidency at the forefront of the crypto revolution.

But why Wrapped Bitcoin, and why now? Let’s dive into the significance of this strategic purchase, the potential implications for the crypto market, and what this could mean for Bitcoin adoption on a broader scale.

1. Why Wrapped Bitcoin (WBTC)?

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin (BTC) that operates on the Ethereum blockchain. Each WBTC is backed 1:1 by Bitcoin, allowing holders to enjoy the benefits of Bitcoin’s value while leveraging Ethereum’s decentralized finance (DeFi) ecosystem.

Trump’s team’s decision to invest in WBTC instead of BTC directly signals a calculated move toward DeFi adoption and interoperability between blockchain networks. By purchasing WBTC, they can participate in Ethereum-based decentralized applications, including staking, liquidity provision, and yield farming, potentially maximizing returns on the $47 million investment.

WBTC Metrics Highlighting Its Appeal:

- Market Cap: WBTC boasts a market cap of over $4.8 billion, ranking it as one of the most significant Bitcoin derivatives in the crypto market.

- Daily Trading Volume: Over $200 million in daily transactions, indicating high liquidity and strong market confidence.

- Utility in DeFi: More than 76% of WBTC in circulation is locked into DeFi protocols, showcasing its importance in decentralized ecosystems.

2. Timing: Why Now?

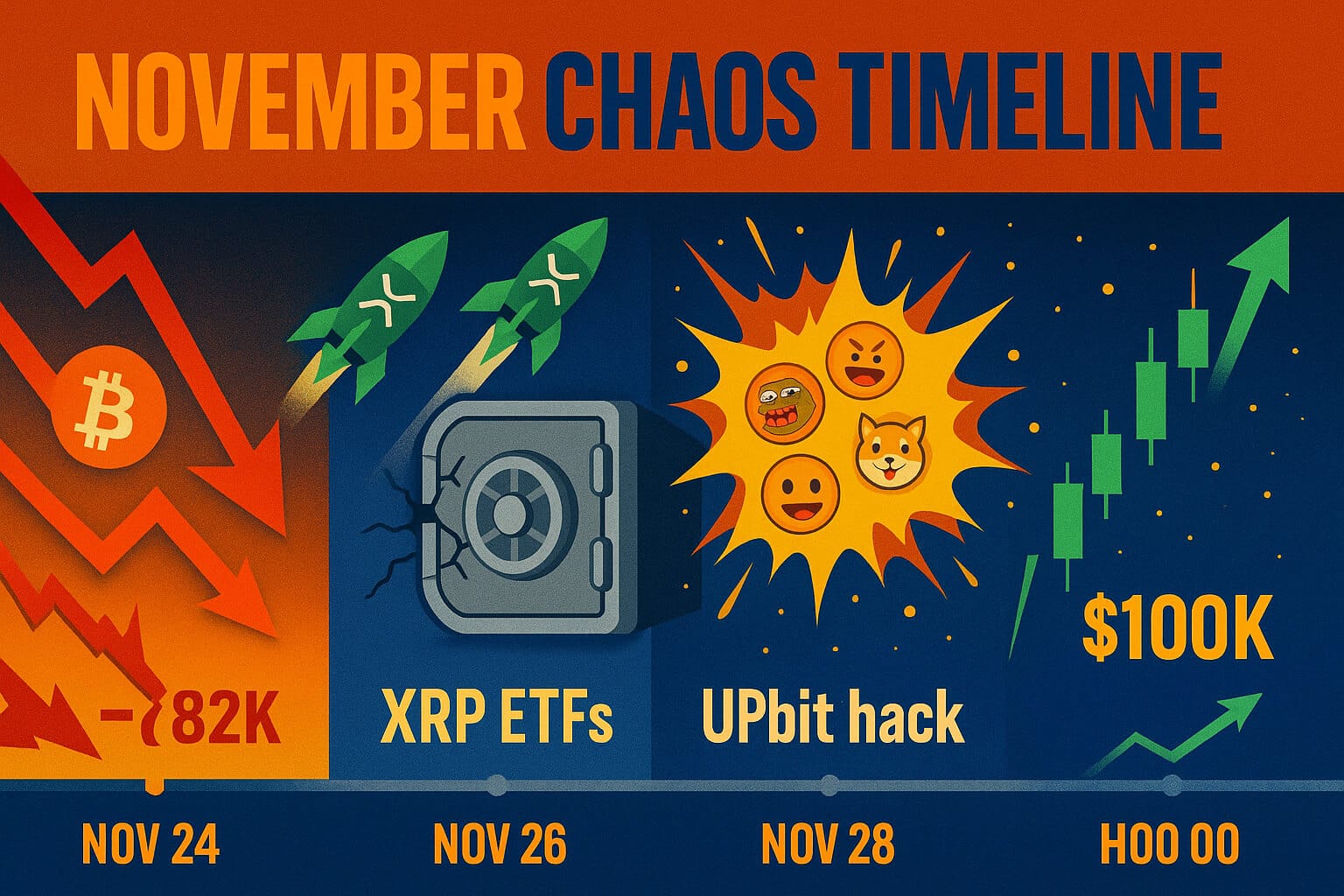

The timing of this large purchase is no coincidence. Several factors likely influenced Trump and his team’s decision to invest in WBTC at this moment:

a) Rising Bitcoin Adoption

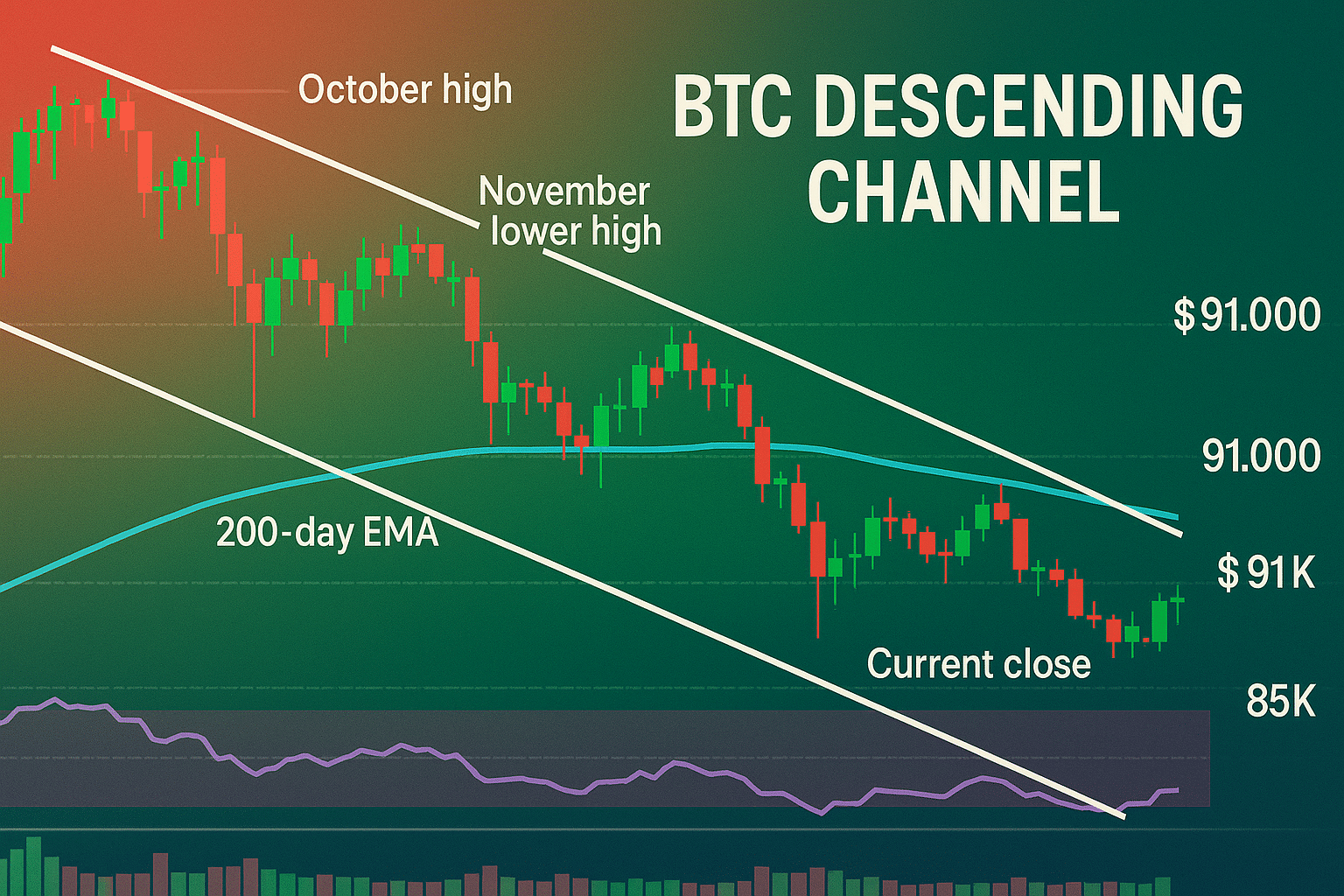

Bitcoin has recently crossed an all-time high of $109,000, and institutional interest has surged. Major players like BlackRock and Fidelity are entering the market with Bitcoin ETFs, and countries such as El Salvador are championing Bitcoin adoption. Trump’s $47 million investment aligns with the growing institutionalization of crypto, signaling his administration’s confidence in Bitcoin’s long-term growth potential.

b) U.S. Crypto Leadership Strategy

As the leader of the United States, Trump’s actions carry global significance. By making a high-profile crypto purchase, he’s signaling a pro-crypto stance for his administration. This move could encourage other governments, corporations, and retail investors to adopt cryptocurrencies, positioning the U.S. as a leader in blockchain innovation.

c) Wrapped Bitcoin’s Role in DeFi Expansion

Ethereum-based DeFi platforms are growing rapidly, with over $60 billion in Total Value Locked (TVL) across various protocols. WBTC plays a crucial role in enabling Bitcoin liquidity within this ecosystem. By investing in WBTC, Trump’s team can tap into DeFi’s vast opportunities, leveraging the flexibility of Ethereum while benefiting from Bitcoin’s value.

3. Breaking Down the $47 Million Purchase

To understand the scale of this investment, it’s helpful to break it down with metrics:

- WBTC Price: At the time of the purchase, WBTC was trading at approximately $93,000 per token, in line with Bitcoin’s price.

- WBTC Acquired: Trump’s team purchased roughly 505 WBTC tokens in this transaction.

- Share of WBTC Market Cap: The $47 million acquisition represents around 1% of WBTC’s total market cap, making it a significant purchase that could influence liquidity and market sentiment.

The rapid execution of this transaction demonstrates the efficiency of crypto markets and highlights the growing capability of high-net-worth individuals and institutions to make large-scale investments in a short period.

4. Implications for the Crypto Market

Trump’s foray into WBTC could have far-reaching implications for the crypto market and beyond:

a) Increased Institutional Confidence

The fact that a sitting U.S. president has directly invested in a Bitcoin-based asset sets a powerful precedent. This move could boost institutional confidence, encouraging more traditional financial players to explore crypto investments.

b) Strengthening WBTC’s Market Position

With over $47 million worth of WBTC purchased in hours, liquidity for WBTC is expected to improve. The transaction also reinforces WBTC’s role as a bridge between Bitcoin and Ethereum ecosystems.

c) Impact on U.S. Crypto Regulations

Trump’s investment signals a potential shift in U.S. crypto policy. His administration may push for regulatory frameworks that encourage innovation while providing clarity for businesses and investors. This could lead to more widespread adoption of crypto assets in the U.S. financial system.

5. Expert Reactions

Trump’s $47 million WBTC purchase has sparked discussions among crypto analysts and financial experts. Here’s what they’re saying:

- Michael Saylor, Executive Chairman of MicroStrategy: “This marks a historic moment for Bitcoin and crypto adoption. Seeing a president align with digital assets will encourage more businesses to follow suit.”

- Cathie Wood, CEO of ARK Invest: “Trump’s WBTC purchase signals the fusion of traditional finance and decentralized finance. It’s a game-changer.”

- Vitalik Buterin, Co-founder of Ethereum: “The investment in WBTC is a nod to Ethereum’s utility as a DeFi platform. This could drive even greater integration between Bitcoin and Ethereum ecosystems.”

6. How Could This Shape Bitcoin’s Future?

Trump’s WBTC purchase not only reinforces Bitcoin’s role as a leading store of value but also opens doors for its use in decentralized applications. Here’s what this could mean for Bitcoin’s future:

- Price Growth: With increased institutional adoption and high-profile endorsements like Trump’s, Bitcoin’s price could continue to rise. Some analysts predict Bitcoin could hit $150,000 in 2025.

- Mainstream Legitimacy: Trump’s investment adds credibility to Bitcoin, potentially attracting a new wave of retail investors who were previously hesitant.

- DeFi Integration: The focus on WBTC highlights the growing importance of interoperability in the crypto space. More Bitcoin liquidity could flow into Ethereum-based protocols, boosting DeFi’s growth.

Conclusion: A Bold Move with Long-Term Implications

President Trump’s $47 million WBTC purchase underscores the growing importance of crypto assets in global finance. By aligning his administration with Bitcoin and Ethereum ecosystems, Trump is positioning the U.S. as a potential leader in blockchain innovation.

This investment is not just a financial bet—it’s a signal to the world that the future of finance lies in decentralization, interoperability, and the transformative power of blockchain technology.

Stay Updated

For the latest updates on Bitcoin, Wrapped Bitcoin (WBTC), and crypto market trends, follow us on:

Stay informed with expert insights and the latest news at FreeCoins24.io.

Special Offer

Ride the wave of Bitcoin’s growth and be part of the revolution! Sign up on Bybit today and claim up to $30,000 in deposit bonuses. Start trading and investing in crypto confidently with a trusted platform.

Start your crypto journey now!