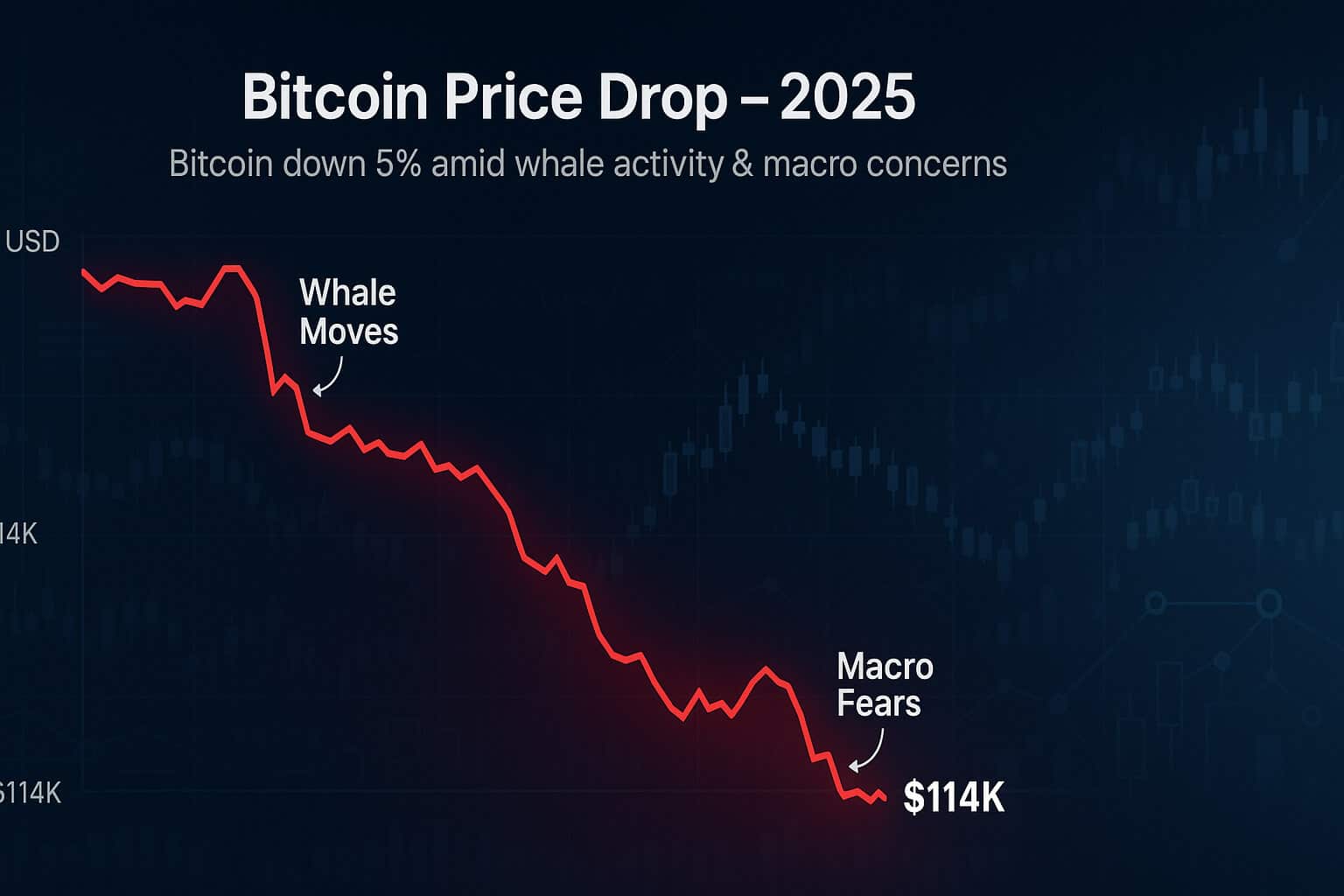

On August 18, 2025, Bitcoin took a wild ride, dropping 5% from ~$120,000 to $114,000–$115,000 in just 24 hours. This Bitcoin Price Crash 2025 Whale Moves Macro Fears erased gains from its $123,182 all-time high earlier this month, leaving investors scrambling. What’s behind this sudden dip? A mix of quiet crypto whales, macroeconomic storm clouds, and a bearish shift in market sentiment is shaking the crypto market. Let’s unpack the chaos with on-chain data, expert insights, and X buzz to see what’s next for Bitcoin.

Ready to trade this Bitcoin dip? Sign up on Bybit and grab up to $30,000 in deposit bonuses to navigate the crypto storm!

1. Whale Moves: Dormant Wallets Wake, But Buying Dries Up

Crypto whales, big players holding thousands of BTC, can move markets with a single transaction. On August 17, on-chain data lit up as dormant wallets from Bitcoin’s early days stirred, shifting funds from legacy P2PK addresses to secure SegWit wallets. Analysts link this to fears of quantum computing vulnerabilities, not outright selling. Still, these moves sparked panic, with traders fearing liquidations.

The bigger issue? Whales have gone quiet on buying. Unlike July’s rally, when whales scooped up $11.2 billion in BTC, the past 24 hours showed zero major purchases. Instead, ~1,800 BTC flowed to exchanges, hinting at profit-taking or repositioning. One whale cashed out $15.4 million near the $120,000 resistance, a historical ceiling. However, a $53 million BTC outflow to cold storage suggests some are holding tight, potentially capping the downside at $114,000–$115,000. Without aggressive buying, this whale silence fueled the Bitcoin Price Crash 2025 Whale Moves Macro Fears.

2. Macro Fears: Inflation, Tariffs, and Fed Uncertainty

Bitcoin’s price is now tightly linked to risk assets like the S&P 500 and Nasdaq (70–90% correlation). The latest dip aligns with macro turbulence rattling markets:

Surging Inflation: July’s U.S. Producer Price Index (PPI) spiked 0.9% month-over-month, far above the expected 0.2%, dimming hopes for Federal Reserve rate cuts in September. With one-year Treasury yields at three-month highs, investors ditched risky assets like Bitcoin for safer bets, triggering $500 million in crypto liquidations.

Trump’s Tariffs: President Trump’s new 10–41% “reciprocal” tariffs on multiple countries have stoked inflation fears and trade war concerns. The crypto market, sensitive to such policies, saw Bitcoin and altcoins like Ethereum drop 2–3%.

Economic Slowdown: Revised U.S. job reports and a 4.2% unemployment rate signal a cooling economy. With $71 billion wiped from crypto markets, Bitcoin’s “digital gold” appeal faded, trading more like a tech stock.

August’s historical weakness (median -8.3% returns) makes this 5% drop feel like a seasonal pullback, amplified by macro headwinds.

3. Market Sentiment: Bearish Signals and ETF Pullbacks

Market sentiment has turned cautious, with traders and institutions stepping back:

Derivatives Shift: Bitcoin futures premiums fell to 6%, showing weaker bullish bets, while options skew leans bearish with increased put buying. The RSI (4-hour chart) at 46.90 nears oversold, and the MACD at -443.38 signals fading momentum.

ETF Outflows: Spot Bitcoin ETFs saw $14.1 million in net outflows on August 15, with BlackRock, ARK, and Grayscale leading the exit, reversing July’s $6 billion inflows. Fidelity’s holdings dropped to 5,290 BTC, reflecting institutional caution.

X Buzz: Social sentiment on X is mixed but bearish-leaning. Users note Bitcoin trading below key SMAs ($118,592, $119,010), warning of a drop to $110,000–$112,000 if $114,000 support breaks. Some call it a “healthy cooldown,” but “zero whale activity” posts dominate.

This bearish tilt has deepened the Bitcoin Price Crash 2025 Whale Moves Macro Fears, with investors awaiting a catalyst.

4. Can Bitcoin Bounce Back?

This 5% drop fits Bitcoin’s post-halving pattern (April 2025), where dips often precede rallies. Support at $112,000–$114,000 (CME futures gap) is holding, with resistance at $117,000–$120,000. If macro fears ease, via Fed clarity or tariff resolutions, a rebound to $120,000+ is possible, backed by BlackRock’s 580,430 BTC holdings.

But risks remain. Ongoing ETF outflows, quiet whales, and economic uncertainty could push Bitcoin to $108,000–$110,000. Analysts like Rekt Capital warn that failing to reclaim $124,500 may cap upside, though long-term targets hit $135,000–$150,000 by year-end. X posts suggest a bounce if RSI hits oversold, but negative MACD urges caution.

5. How to Navigate the Bitcoin Dip

Facing the Bitcoin Price Crash 2025 Whale Moves Macro Fears? Here’s your game plan:

Hold Steady: Avoid panic-selling. Bitcoin rebounded from similar dips, like $80,000 to $82,629 in March 2025.

Buy ETFs: Use Bitcoin ETFs on Bybit for buffered exposure.

Diversify: Mix in altcoins like Solana, resilient in past crashes.

Watch Signals: Monitor Fed announcements, on-chain flows, and X sentiment for rebound cues.

Manage Risk: Cap leverage at 5x and target accumulation zones like BTC at $112,000–$114,000.

Check our Cryptocurrency Investment Guides for more crypto investment strategies.

Special Offer

Looking to trade Bitcoin or other crypto? Sign up on Bybit today and take advantage of up to $30,000 in deposit bonuses. Don’t miss out on trading these innovative assets on a top exchange!

Conclusion

The Bitcoin Price Crash 2025 Whale Moves Macro Fears, a 5% drop to $114,000, $115,000, stems from quiet whales, macro pressures like Trump’s tariffs and inflation, and bearish market sentiment. While not a full-blown crash, it shows Bitcoin’s sensitivity to global risks. With support at $112,000 and potential catalysts like Fed clarity, this could be a dip to buy. Stay sharp, check CoinDesk for updates and join the conversation on Twitter or Telegram!

For more crypto trends, visit our Cryptocurrency Investment Guides.

Stay in the loop with the latest crypto airdrops, strategies, and tips. Follow us on:

Want more in-depth analysis and airdrop opportunities? Visit FreeCoins24.io/airdrops to explore the latest free crypto drops.