1. Introduction: The Importance of Layer 1 Solutions in Blockchain

Layer 1 solutions are the backbone of the blockchain ecosystem. These foundational blockchains validate transactions, maintain consensus, and secure the network. As the core layer, Layer 1 blockchains like Bitcoin and Ethereum are essential for decentralized networks, serving as the bedrock for other technologies, such as Layer 2 solutions. In this article, we’ll explore the most popular Layer 1 solutions, focusing on what makes them integral to blockchain and cryptocurrency.

2. What Are Layer 1 Solutions?

Defining Layer 1 Blockchains

Layer 1 blockchains are fundamental protocols in a blockchain network. They handle all basic operations, including transaction processing, consensus, and security. Unlike Layer 2 solutions, which improve scalability and efficiency on top of Layer 1, Layer 1 blockchains operate directly on the underlying blockchain infrastructure.

Core Functions of Layer 1 Solutions

- Transaction Processing: Layer 1 blockchains process and record transactions on the blockchain ledger.

- Consensus Mechanisms: These blockchains use consensus algorithms like Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions and secure the network.

- Smart Contract Execution: Some Layer 1 blockchains, like Ethereum, support smart contracts, allowing for the creation of decentralized applications (dApps).

- Security and Decentralization: Layer 1 solutions maintain the security and decentralization of the blockchain network.

3. Popular Layer 1 Solutions in the Blockchain Ecosystem

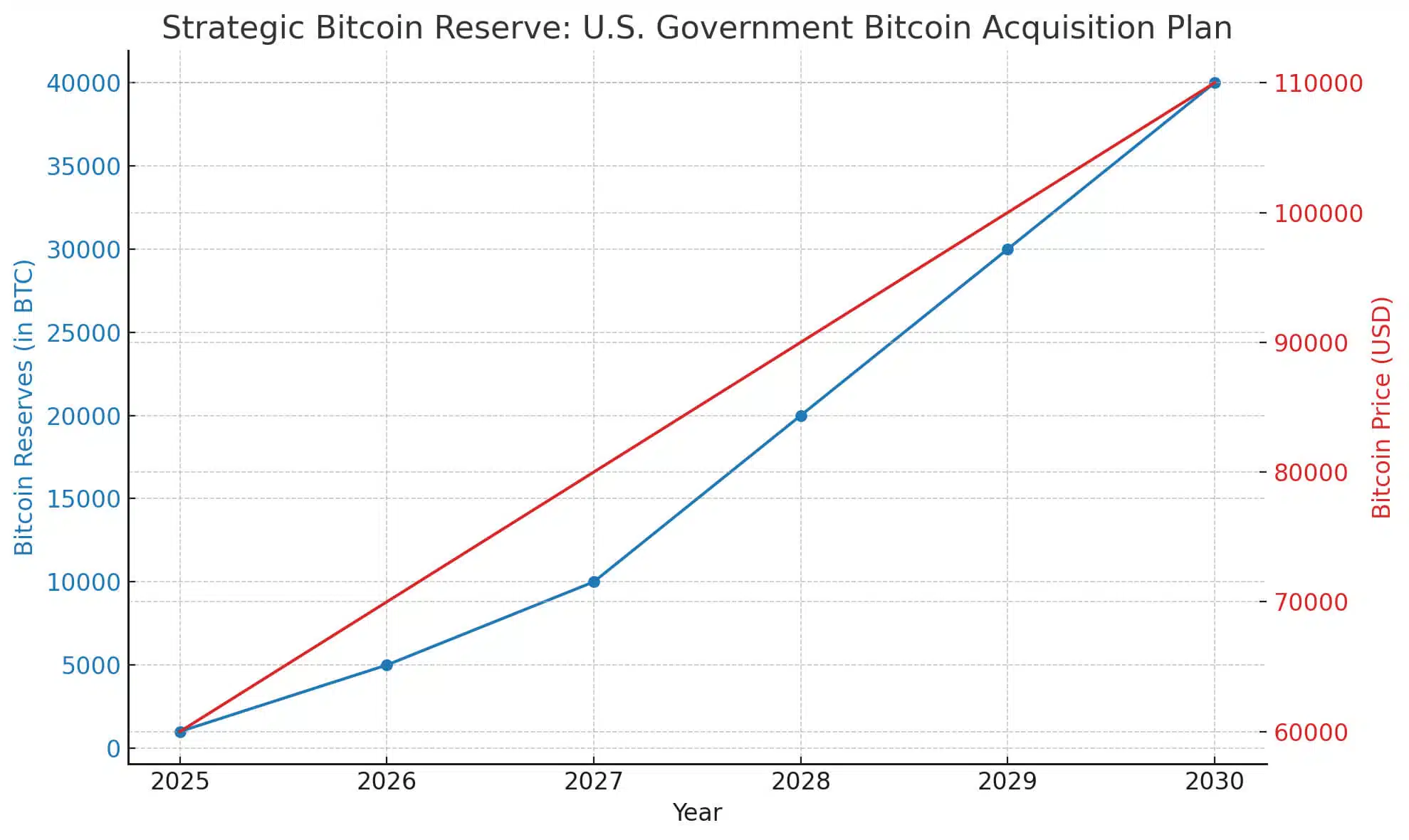

Bitcoin (BTC): The Pioneer of Layer 1 Blockchains

Bitcoin is the original cryptocurrency and the first successful implementation of a Layer 1 blockchain. Launched in 2009 by an anonymous person or group known as Satoshi Nakamoto, Bitcoin introduced the world to the concept of decentralized digital currency.

Key Features:

- Proof of Work (PoW) Consensus: Bitcoin uses PoW, where miners solve complex puzzles to validate transactions and add new blocks to the blockchain.

- Security and Decentralization: Bitcoin’s network is highly secure and decentralized, with thousands of nodes worldwide ensuring the blockchain’s integrity.

- Limited Supply: Bitcoin has a capped supply of 21 million coins, making it a deflationary asset and a popular store of value.

Use Cases:

Bitcoin is primarily used as a store of value and a medium of exchange. It is often referred to as “digital gold” and is seen as a hedge against inflation.

Ethereum (ETH): The Smart Contract Pioneer

Ethereum, launched in 2015 by Vitalik Buterin and his team, is a Layer 1 blockchain that introduced the concept of smart contracts. Unlike Bitcoin, designed as a digital currency, Ethereum serves as a decentralized platform for building and running decentralized applications (dApps).

Key Features:

- Smart Contracts: Ethereum allows developers to create and deploy smart contracts, which are self-executing contracts with the terms of the agreement written into code.

- Decentralized Applications (dApps): Ethereum’s blockchain hosts a vast ecosystem of dApps, from decentralized finance (DeFi) platforms to non-fungible token (NFT) marketplaces.

- Transition to Proof of Stake (PoS): Ethereum is transitioning from PoW to PoS, reducing its energy consumption and improving scalability.

Use Cases:

Ethereum is the leading platform for decentralized applications and smart contracts, making it the go-to blockchain for developers in the crypto space.

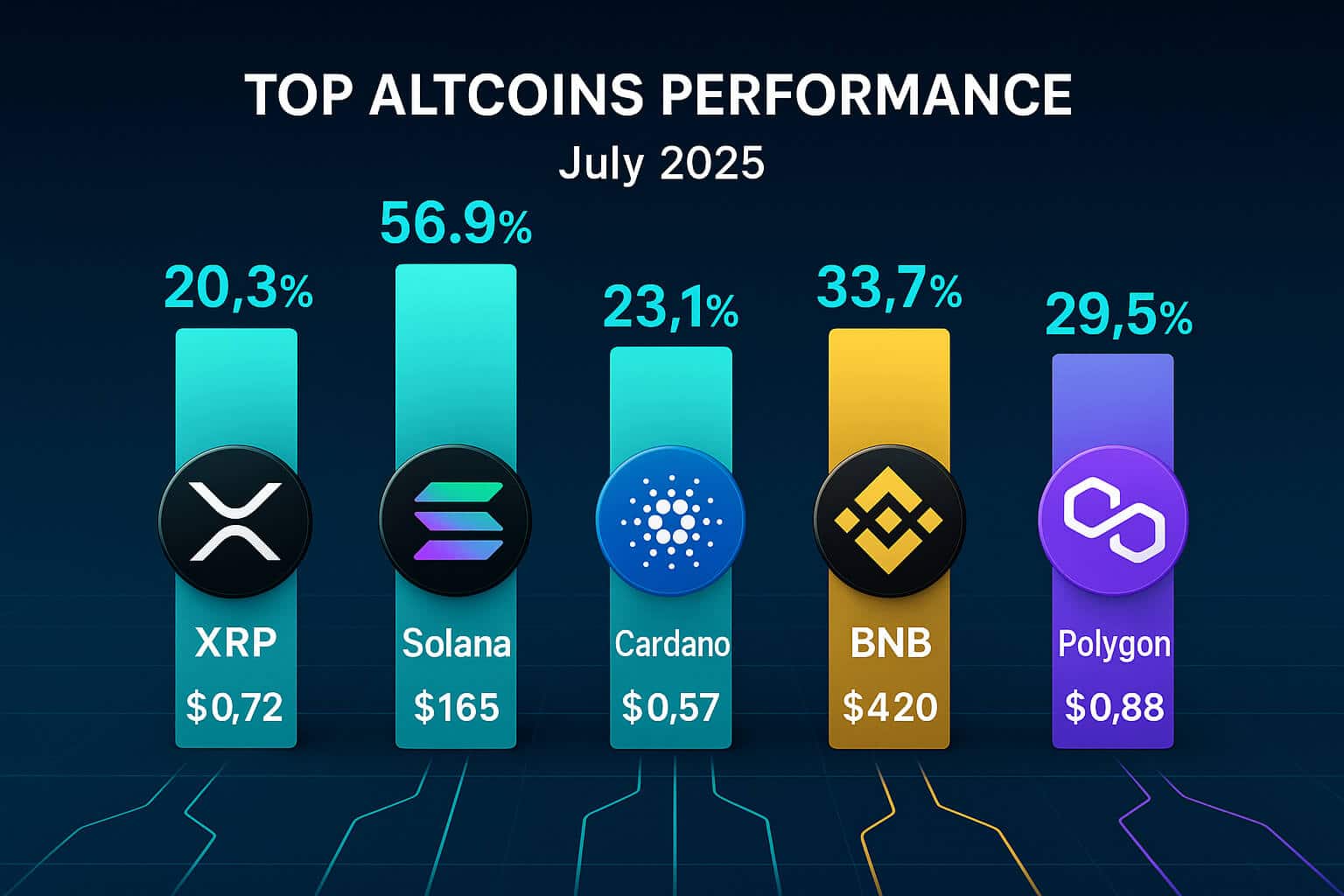

Binance Smart Chain (BSC): Fast and Cost-Efficient

Binance Smart Chain (BSC) is a Layer 1 blockchain developed by the Binance exchange. Launched in 2020, BSC was designed to provide a high-performance blockchain with low transaction fees, making it an attractive alternative to Ethereum.

Key Features:

- Proof of Staked Authority (PoSA): BSC uses a Proof of Staked Authority (PoSA) consensus mechanism, combining elements of PoS and Proof of Authority (PoA) to achieve fast transaction times and low fees.

- Compatibility with Ethereum: BSC is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily port their Ethereum dApps to BSC.

- Growing Ecosystem: BSC has quickly become one of the most popular blockchains for decentralized finance (DeFi) and non-fungible tokens (NFTs), with a rapidly expanding ecosystem of dApps.

Use Cases:

BSC is widely used for DeFi applications, NFT platforms, and other dApps that require fast, low-cost transactions.

Cardano (ADA): A Focus on Security and Sustainability

Cardano is a Layer 1 blockchain platform that emphasizes security, scalability, and sustainability. Developed by Input Output Hong Kong (IOHK) and led by Charles Hoskinson, Cardano was designed with a research-driven approach to ensure the highest levels of security and performance.

Key Features:

- Ouroboros Proof of Stake (PoS): Cardano uses the Ouroboros PoS consensus mechanism, which is highly energy-efficient and secure, making it one of the most sustainable blockchain networks.

- Modular Design: Cardano’s architecture is modular, allowing for continuous upgrades and improvements without disrupting the network.

- Peer-Reviewed Research: Cardano is built on peer-reviewed research and formal methods, ensuring that its protocols are rigorously tested and verified.

Use Cases:

Cardano is used for various applications, including decentralized finance (DeFi), identity management, and supply chain tracking, with a strong focus on sustainability and long-term growth.

Solana (SOL): High-Speed Transactions

Solana is a high-performance Layer 1 blockchain known for its speed and low transaction costs. Launched in 2020, Solana has quickly gained popularity as a platform for decentralized applications (dApps) and decentralized finance (DeFi) due to its ability to handle a high throughput of transactions.

Key Features:

- Proof of History (PoH): Solana’s unique consensus algorithm, Proof of History (PoH), allows the blockchain to process thousands of transactions per second, making it one of the fastest Layer 1 solutions.

- Scalability: Solana’s architecture is designed for scalability, enabling the network to handle a large number of transactions without compromising speed or security.

- Low Transaction Fees: Solana offers extremely low transaction fees, making it a cost-effective platform for developers and users.

Use Cases:

Solana is popular for DeFi applications, NFT platforms, and other dApps that require fast and scalable transaction processing.

4. Key Differences Between Popular Layer 1 Solutions

Consensus Mechanisms

- Bitcoin: Uses Proof of Work (PoW) for security and decentralization.

- Ethereum: Initially used PoW but is transitioning to Proof of Stake (PoS) for improved efficiency.

- Binance Smart Chain (BSC): Employs Proof of Staked Authority (PoSA) for fast transactions and low fees.

- Cardano: Utilizes Ouroboros PoS, known for its energy efficiency and security.

- Solana: Implements Proof of History (PoH) for high-speed transaction processing.

Transaction Speed and Cost

- Bitcoin: Relatively slow with higher transaction fees, primarily used as a store of value.

- Ethereum: Moderate speed with varying transaction fees, popular for smart contracts and dApps.

- Binance Smart Chain (BSC): Fast transactions with low fees, ideal for DeFi and NFTs.

- Cardano: Focuses on sustainability with moderate transaction speeds and low fees.

- Solana: Extremely fast with low fees, making it suitable for high-frequency transactions and large-scale dApps.

Use Cases and Ecosystems

- Bitcoin: Primarily used as digital gold and a medium of exchange.

- Ethereum: The leading platform for decentralized applications, smart contracts, and DeFi.

- Binance Smart Chain (BSC): Popular for DeFi, NFTs, and other dApps due to its cost-effectiveness.

- Cardano: Focuses on DeFi, identity management, and supply chain applications with a sustainable approach.

- Solana: Ideal for DeFi, NFTs, and dApps that require high throughput and low costs.

5. Conclusion

Understanding Layer 1 Solutions: The Backbone of Blockchain Technology

Layer 1 solutions are the foundational blocks of the blockchain ecosystem, providing the essential infrastructure for decentralized networks. From Bitcoin’s pioneering role as digital gold to Ethereum’s innovative smart contracts and Solana’s high-speed transactions, each Layer 1 blockchain offers unique strengths and use cases. As the blockchain industry continues to evolve, these popular Layer 1 solutions will remain critical to the growth and development of decentralized applications, digital finance, and the broader cryptocurrency ecosystem.

For more insights and detailed guides on blockchain technology and cryptocurrency, visit our Cryptocurrency Comparisons Guides.

Stay Updated

For the latest insights on Layer 1 solutions, blockchain technology, and other decentralized innovations, follow us on:

Stay informed with the latest strategies and developments in the cryptocurrency space at FreeCoins24.io.

Special Offer

For an enhanced trading experience, consider Bybit. Sign up through our referral link to unlock exclusive rewards, including up to $30,000 in deposit bonuses, and elevate your trading journey.